iyeung144.github.io

My Github Pages

Hong Kong Stock 3

by Yeung Ka Ming, CFA

Summary

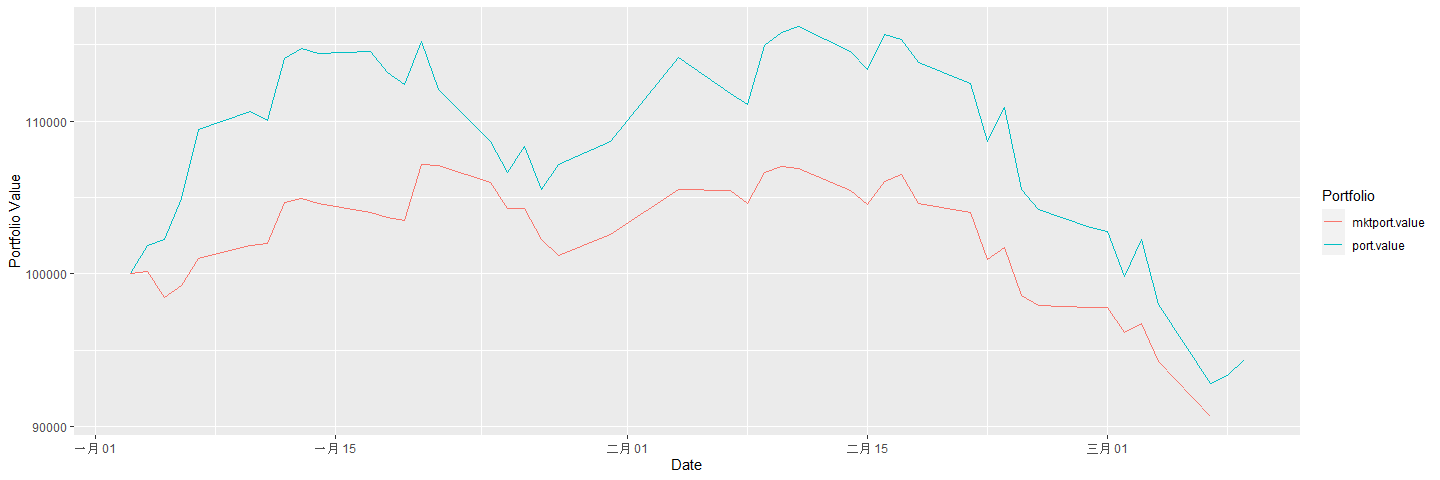

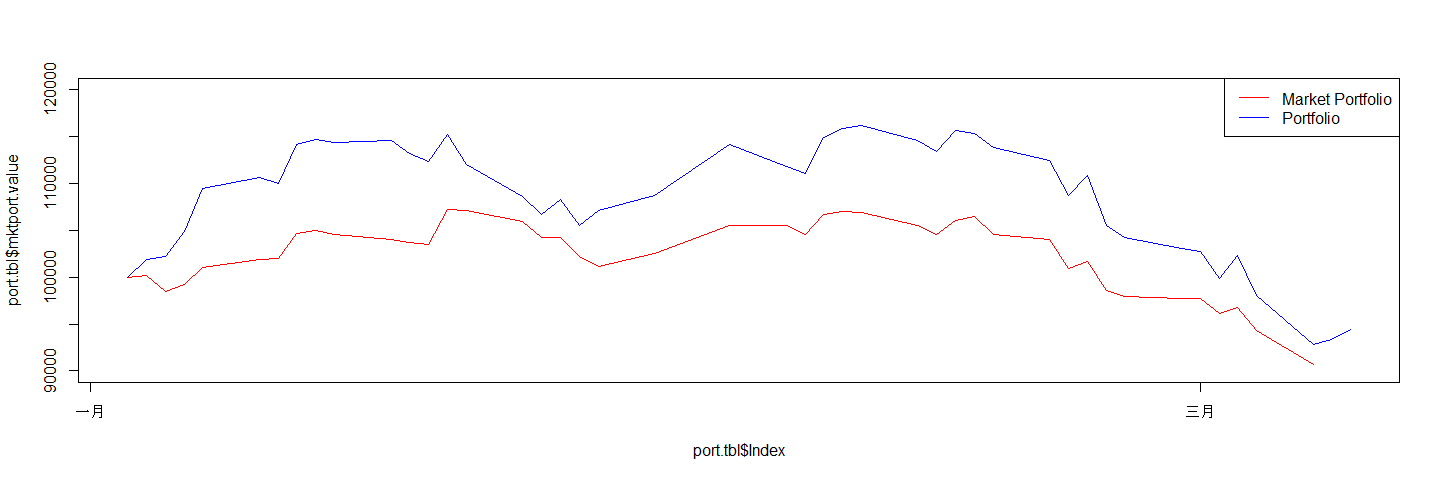

Compare return to market portfolio. The market portfolio for Hong Kong stock market is HSI Tracker ETF, 2800.HK

R Libraries

library(quantmod)

library(tidyverse)

library(ggplot2)

Preparation of data

Direct download by getSymbols

tickers <- c("0005.HK","9988.HK", "2800.HK")

hkport <- new.env()

getSymbols(tickers,

env=hkport,

src = "yahoo",

index.class = "POSIXct",

from = "2022-01-01")

## [1] "0005.HK" "9988.HK" "2800.HK"

# auto.assign is FALSE, so an environment is used here.

# Unlike US stocks, # the tickers in HK stock market is

# by number, which cannot be the variable

# name in R. Further fine tune in next step.

Rename column names

HSBC<-hkport$`0005.HK`

BABA<-hkport$`9988.HK`

HKTR<-hkport$`2800.HK`

# substitute numeric ticker name to character name. It is inconvenient to handle

# variable name starts with number.

colnames(BABA) <- sub("9988.HK","BABA",colnames(hkport$`9988.HK`))

head(hkport$`9988.HK`)

## 9988.HK.Open 9988.HK.High 9988.HK.Low 9988.HK.Close 9988.HK.Volume 9988.HK.Adjusted

## 2022-01-03 117.0 117.5 114.0 115.0 22176946 115.0

## 2022-01-04 118.4 118.9 115.7 116.9 23228903 116.9

## 2022-01-05 119.0 119.1 113.9 114.5 30717509 114.5

## 2022-01-06 117.5 121.1 117.3 121.0 47231895 121.0

## 2022-01-07 126.5 128.8 122.8 128.8 58778943 128.8

## 2022-01-10 128.8 129.5 125.4 127.6 36814976 127.6

head(BABA)

## BABA.Open BABA.High BABA.Low BABA.Close BABA.Volume BABA.Adjusted

## 2022-01-03 117.0 117.5 114.0 115.0 22176946 115.0

## 2022-01-04 118.4 118.9 115.7 116.9 23228903 116.9

## 2022-01-05 119.0 119.1 113.9 114.5 30717509 114.5

## 2022-01-06 117.5 121.1 117.3 121.0 47231895 121.0

## 2022-01-07 126.5 128.8 122.8 128.8 58778943 128.8

## 2022-01-10 128.8 129.5 125.4 127.6 36814976 127.6

colnames(HSBC) <- sub("0005.HK","HSBC",colnames(hkport$`0005.HK`))

head(hkport$`0005.HK`)

## 0005.HK.Open 0005.HK.High 0005.HK.Low 0005.HK.Close 0005.HK.Volume 0005.HK.Adjusted

## 2022-01-03 47.00 47.15 46.65 46.85 6711558 46.67877

## 2022-01-04 47.10 47.80 47.00 47.80 25500155 47.62530

## 2022-01-05 49.35 49.75 48.75 49.15 59292303 48.97037

## 2022-01-06 49.05 49.05 48.35 49.00 24559582 48.82091

## 2022-01-07 50.10 50.15 49.75 50.10 67407695 49.91689

## 2022-01-10 50.80 51.75 50.60 51.70 59640904 51.51105

head(HSBC)

## HSBC.Open HSBC.High HSBC.Low HSBC.Close HSBC.Volume HSBC.Adjusted

## 2022-01-03 47.00 47.15 46.65 46.85 6711558 46.67877

## 2022-01-04 47.10 47.80 47.00 47.80 25500155 47.62530

## 2022-01-05 49.35 49.75 48.75 49.15 59292303 48.97037

## 2022-01-06 49.05 49.05 48.35 49.00 24559582 48.82091

## 2022-01-07 50.10 50.15 49.75 50.10 67407695 49.91689

## 2022-01-10 50.80 51.75 50.60 51.70 59640904 51.51105

colnames(HKTR) <- sub("2800.HK","HKTR",colnames(hkport$`2800.HK`))

head(hkport$`2800.HK`)

## 2800.HK.Open 2800.HK.High 2800.HK.Low 2800.HK.Close 2800.HK.Volume 2800.HK.Adjusted

## 2022-01-03 23.66 23.76 23.34 23.40 100227198 23.40

## 2022-01-04 23.52 23.58 23.28 23.44 74708335 23.44

## 2022-01-05 23.44 23.44 23.00 23.04 149530742 23.04

## 2022-01-06 23.00 23.22 22.86 23.22 116238361 23.22

## 2022-01-07 23.40 23.66 23.28 23.64 169287010 23.64

## 2022-01-10 23.62 23.92 23.54 23.84 187033452 23.84

head(HKTR)

## HKTR.Open HKTR.High HKTR.Low HKTR.Close HKTR.Volume HKTR.Adjusted

## 2022-01-03 23.66 23.76 23.34 23.40 100227198 23.40

## 2022-01-04 23.52 23.58 23.28 23.44 74708335 23.44

## 2022-01-05 23.44 23.44 23.00 23.04 149530742 23.04

## 2022-01-06 23.00 23.22 22.86 23.22 116238361 23.22

## 2022-01-07 23.40 23.66 23.28 23.64 169287010 23.64

## 2022-01-10 23.62 23.92 23.54 23.84 187033452 23.84

Prepare a dataframe with portfolio value and plot graph

Prepare dataframe

# Suppose $100,000 for investment on the first trading

# day of 2022.

# Use around half of the amount for each stock (50/50)

moneyseed <- 100000

portion <- 0.5

shares <- c(portion*moneyseed/HSBC$HSBC.Adjusted[[1]],

portion*moneyseed/BABA$BABA.Adjusted[[1]],

moneyseed/HKTR$HKTR.Adjusted[[1]])

# need stock adjusted prices and number of shares to make a portfolio

prices.tbl <- as_tibble(fortify(merge(HSBC, BABA, HKTR)))

port.tbl <- prices.tbl %>%

select(Index,HSBC.Adjusted,BABA.Adjusted,HKTR.Adjusted)

port.tbl

## # A tibble: 45 x 4

## Index HSBC.Adjusted BABA.Adjusted HKTR.Adjusted

## <dttm> <dbl> <dbl> <dbl>

## 1 2022-01-03 00:00:00 46.7 115 23.4

## 2 2022-01-04 00:00:00 47.6 117. 23.4

## 3 2022-01-05 00:00:00 49.0 114. 23.0

## 4 2022-01-06 00:00:00 48.8 121 23.2

## 5 2022-01-07 00:00:00 49.9 129. 23.6

## 6 2022-01-10 00:00:00 51.5 128. 23.8

## 7 2022-01-11 00:00:00 51.8 126. 23.9

## 8 2022-01-12 00:00:00 52.6 133 24.5

## 9 2022-01-13 00:00:00 53.5 132. 24.6

## 10 2022-01-14 00:00:00 54.4 129. 24.5

## # ... with 35 more rows

port.tbl <- port.tbl %>%

mutate(port.value = shares[1]*HSBC.Adjusted +

shares[2]*BABA.Adjusted) %>%

mutate(mktport.value = shares[3]*HKTR.Adjusted)

port.tbl

## # A tibble: 45 x 6

## Index HSBC.Adjusted BABA.Adjusted HKTR.Adjusted port.value mktport.value

## <dttm> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 2022-01-03 00:00:00 46.7 115 23.4 100000 100000

## 2 2022-01-04 00:00:00 47.6 117. 23.4 101840. 100171.

## 3 2022-01-05 00:00:00 49.0 114. 23.0 102237. 98462.

## 4 2022-01-06 00:00:00 48.8 121 23.2 104903. 99231.

## 5 2022-01-07 00:00:00 49.9 129. 23.6 109469. 101026.

## 6 2022-01-10 00:00:00 51.5 128. 23.8 110654. 101880.

## 7 2022-01-11 00:00:00 51.8 126. 23.9 110052. 101966.

## 8 2022-01-12 00:00:00 52.6 133 24.5 114123. 104701.

## 9 2022-01-13 00:00:00 53.5 132. 24.6 114735. 104957.

## 10 2022-01-14 00:00:00 54.4 129. 24.5 114435. 104615.

## # ... with 35 more rows

Plot graph

plot(x = port.tbl$Index,

y = port.tbl$mktport.value,

type="l", col="red", ylim = c(90000,120000))

lines(x = port.tbl$Index, y = port.tbl$port.value,

type="l", col="blue")

legend(x = "topright",

legend=c("Market Portfolio", "Portfolio"),

lty=c(1,1),col=c("red", "blue"))

port.long.tbl <- port.tbl %>%

pivot_longer(c(port.value,mktport.value),

names_to = "Portfolio",

values_to = "Value") %>%

select(c(Index,Portfolio,Value))

port.long.tbl

## # A tibble: 90 x 3

## Index Portfolio Value

## <dttm> <chr> <dbl>

## 1 2022-01-03 00:00:00 port.value 100000

## 2 2022-01-03 00:00:00 mktport.value 100000

## 3 2022-01-04 00:00:00 port.value 101840.

## 4 2022-01-04 00:00:00 mktport.value 100171.

## 5 2022-01-05 00:00:00 port.value 102237.

## 6 2022-01-05 00:00:00 mktport.value 98462.

## 7 2022-01-06 00:00:00 port.value 104903.

## 8 2022-01-06 00:00:00 mktport.value 99231.

## 9 2022-01-07 00:00:00 port.value 109469.

## 10 2022-01-07 00:00:00 mktport.value 101026.

## # ... with 80 more rows

p2 <- ggplot(port.long.tbl,

aes(x=Index, y=Value, color=Portfolio))

p2 + xlab("Date") + ylab("Portfolio Value") + geom_line()