iyeung144.github.io

My Github Pages

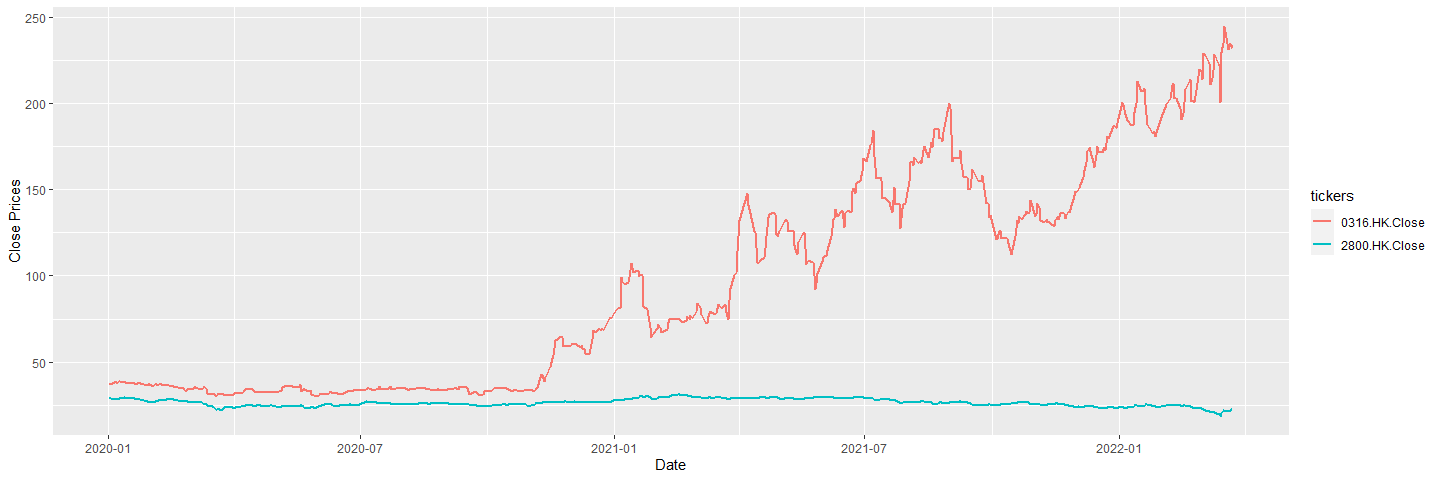

Hong Kong Stock 5

by Yeung Ka Ming, CFA

Summary

OOCL is a shipping company and the performance during the pandemic is extraordinary.

R Libraries

library(quantmod)

library(tidyverse)

library(ggplot2)

Preparation of data

Direct download by getSymbols

tickers <- c('0316.HK','2800.HK')

hkport <- new.env()

getSymbols(tickers,

env=hkport,

src = "yahoo",

index.class = "POSIXct",

from = "2020-01-01")

## [1] "0316.HK" "2800.HK"

# auto.assign is FALSE, so an environment is used here.

# Unlike US stocks, # the tickers in HK stock market is

# by number, which cannot be the variable

# name in R. Further fine tune in next step.

OHLC price

head(Ad(hkport$`0316.HK`))

## 0316.HK.Adjusted

## 2020-01-02 29.70684

## 2020-01-03 29.15525

## 2020-01-06 30.61301

## 2020-01-07 29.94323

## 2020-01-08 29.78563

## 2020-01-09 30.88880

head(Cl(hkport$`0316.HK`))

## 0316.HK.Close

## 2020-01-02 37.70

## 2020-01-03 37.00

## 2020-01-06 38.85

## 2020-01-07 38.00

## 2020-01-08 37.80

## 2020-01-09 39.20

head(Op(hkport$`0316.HK`))

## 0316.HK.Open

## 2020-01-02 37.80

## 2020-01-03 37.65

## 2020-01-06 37.05

## 2020-01-07 37.65

## 2020-01-08 37.65

## 2020-01-09 38.45

head(Hi(hkport$`0316.HK`))

## 0316.HK.High

## 2020-01-02 37.80

## 2020-01-03 37.80

## 2020-01-06 39.45

## 2020-01-07 38.75

## 2020-01-08 39.35

## 2020-01-09 39.20

head(Lo(hkport$`0316.HK`))

## 0316.HK.Low

## 2020-01-02 37.75

## 2020-01-03 37.00

## 2020-01-06 37.05

## 2020-01-07 37.65

## 2020-01-08 37.65

## 2020-01-09 37.60

Prepare a dataframe with all adjusted close prices

Prepare dataframe

## To get all the close prices

## into a single xts object

cl.stocks.xts <- Reduce(merge,eapply(hkport, Cl))

colnames(cl.stocks.xts) <- sub('X','',colnames(cl.stocks.xts))

cl.stocks.tbl <- as_tibble(fortify(cl.stocks.xts))

cl.stocks.long.tbl <- cl.stocks.tbl %>%

pivot_longer(!Index,

names_to = "tickers",

values_to = "Close.Prices")

cl.stocks.long.tbl

## # A tibble: 1,102 x 3

## Index tickers Close.Prices

## <dttm> <chr> <dbl>

## 1 2020-01-02 00:00:00 0316.HK.Close 37.7

## 2 2020-01-02 00:00:00 2800.HK.Close 28.7

## 3 2020-01-03 00:00:00 0316.HK.Close 37

## 4 2020-01-03 00:00:00 2800.HK.Close 28.6

## 5 2020-01-06 00:00:00 0316.HK.Close 38.8

## 6 2020-01-06 00:00:00 2800.HK.Close 28.5

## 7 2020-01-07 00:00:00 0316.HK.Close 38

## 8 2020-01-07 00:00:00 2800.HK.Close 28.5

## 9 2020-01-08 00:00:00 0316.HK.Close 37.8

## 10 2020-01-08 00:00:00 2800.HK.Close 28.2

## # ... with 1,092 more rows

Plot graph

p4 <- ggplot(cl.stocks.long.tbl,

aes(x = Index,

y = Close.Prices,

color=tickers))

p4 +

geom_line(size = 1) +

xlab("Date") +

ylab("Close Prices")